Impact Investment

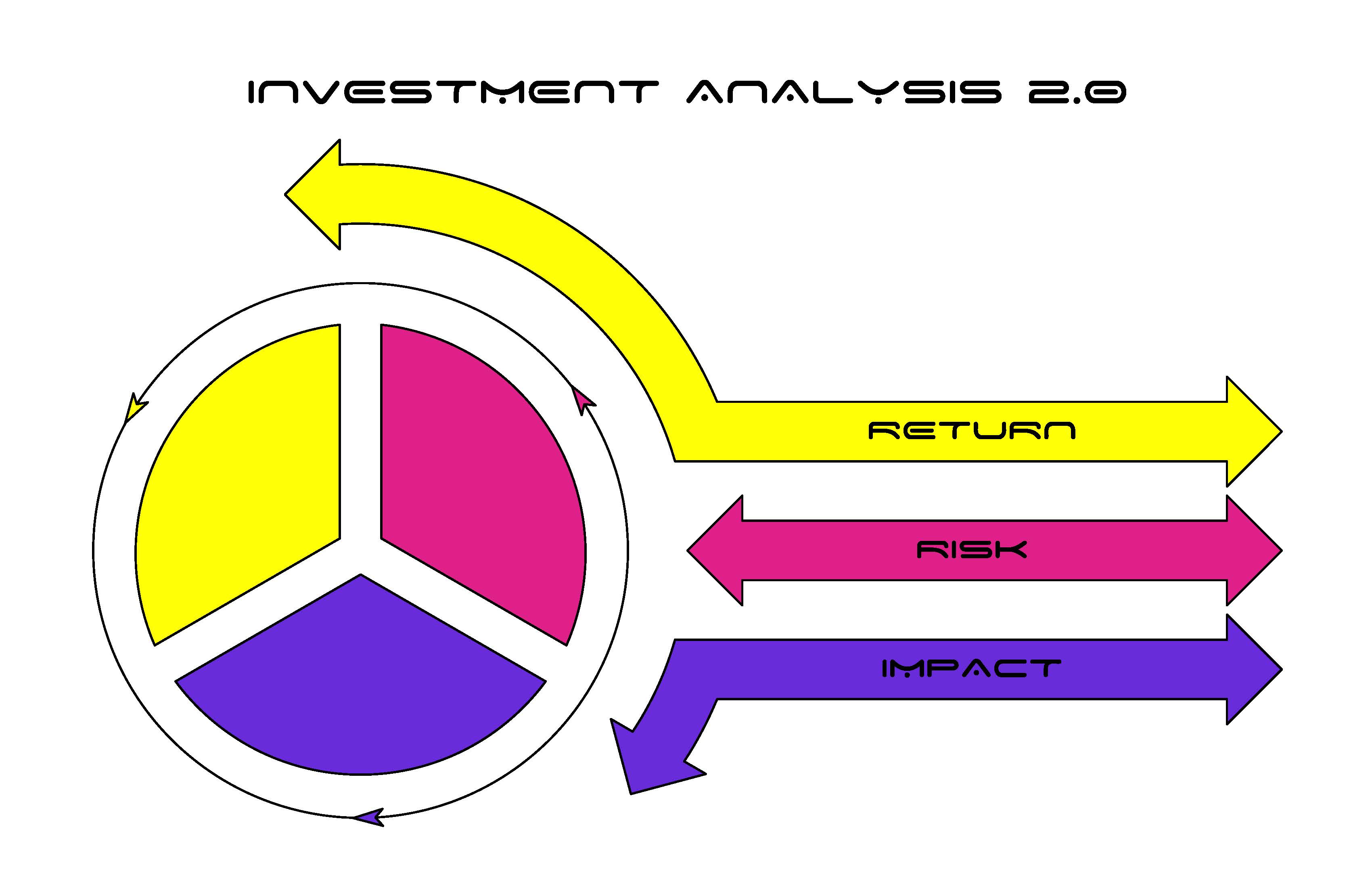

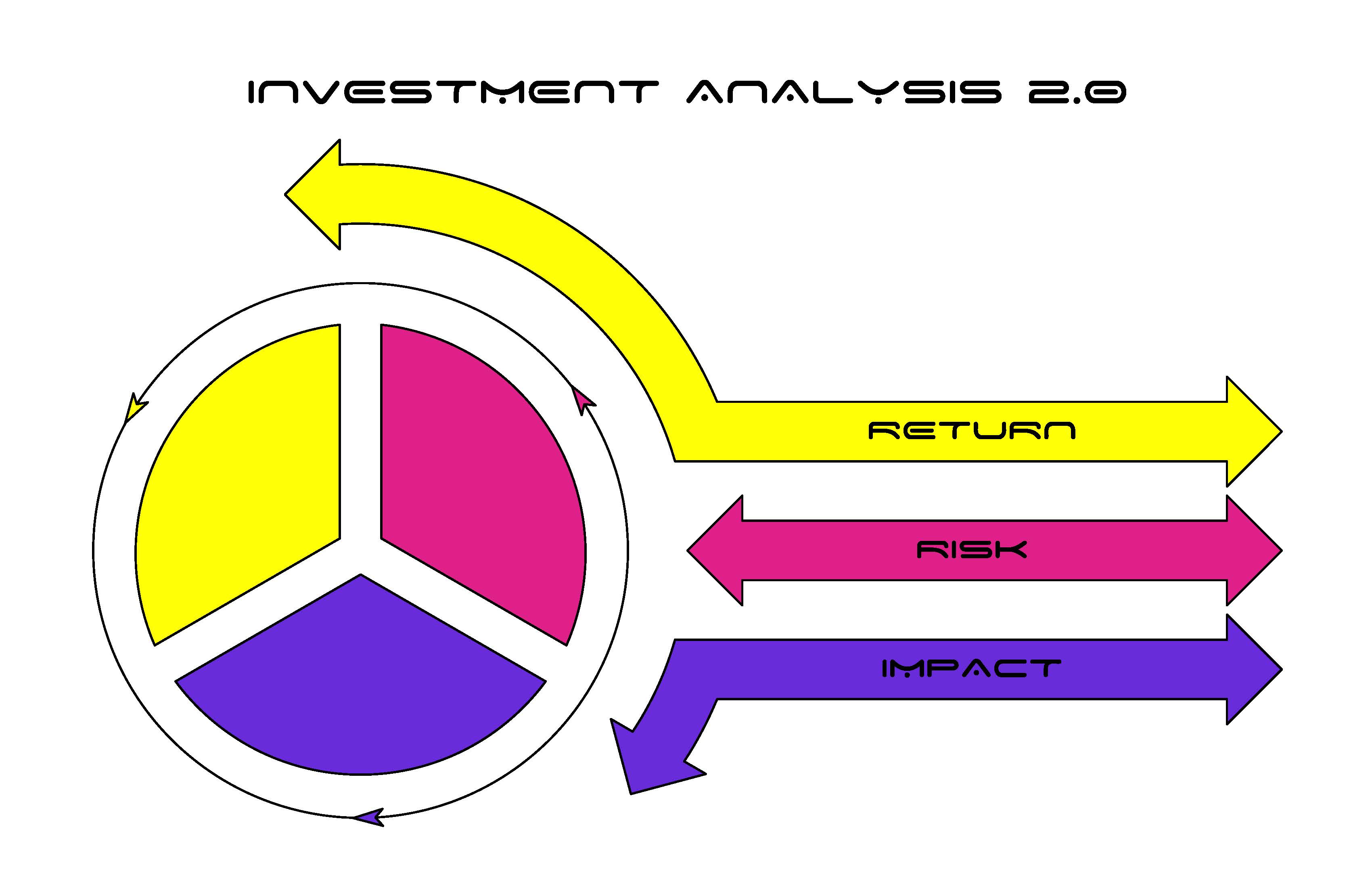

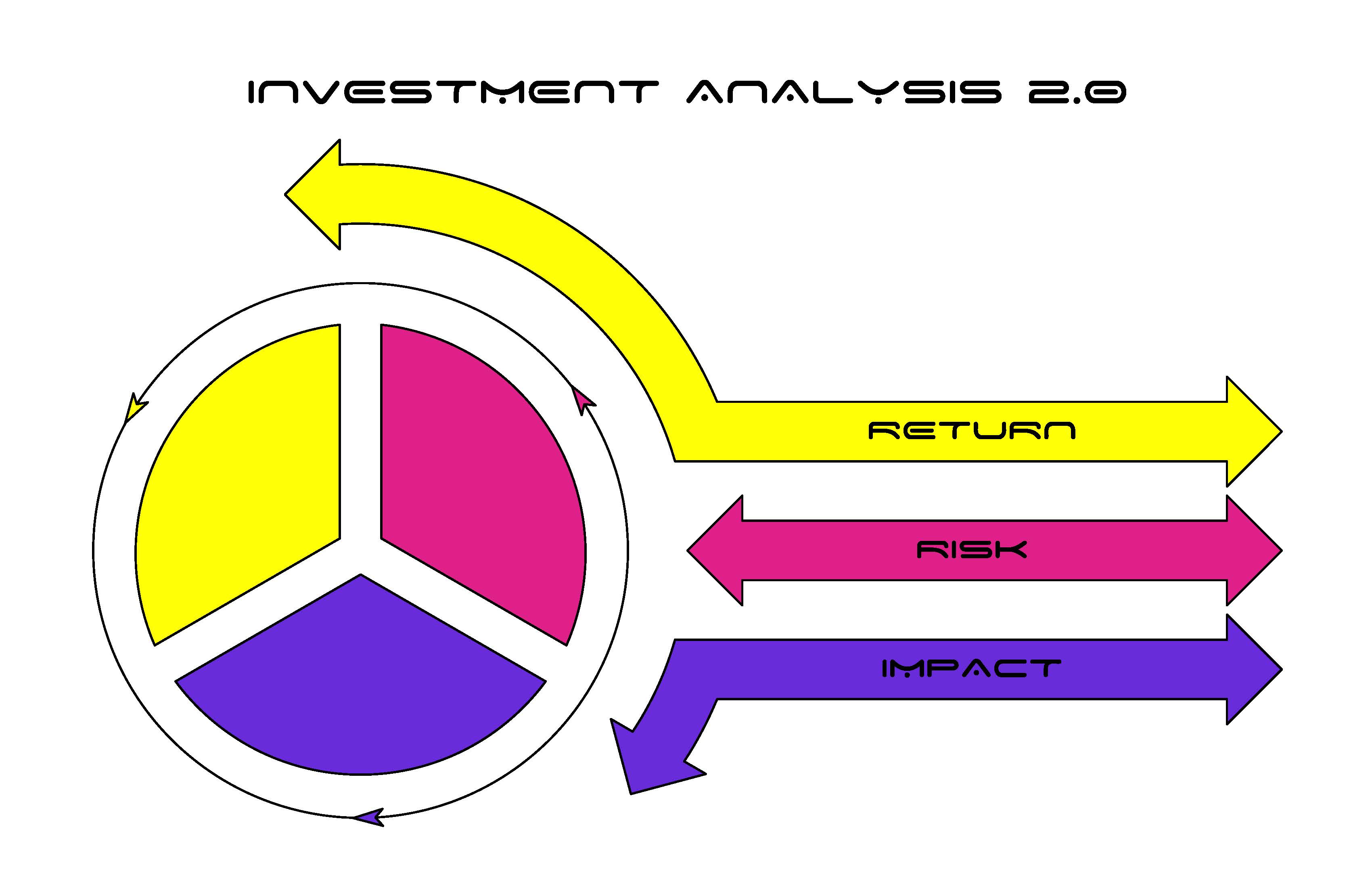

Trillions of dollars are invested across pension schemes globally largely based on backward looking risk and return data. We need to see a paradigm shift in how investments are analysed and portfolios are constructed, whereby the impact of companies across all stakeholders, including the environment, is explicitly considered alongside risk and return.

An Impact Framework

The impact investment sector, still in the early stages of evolution, has provided examples of how business can be used to drive social change. We are now seeing the concept move to the mainstream and traditional investors are putting their own mark on how impact investing is defined.

Since there is no one framework for defining and measuring the social or environment impact return of an investment or even an agreed minimum standard for an investment to be considered an “impact investment”, the term has become wide encompassing.

To add to the confusion for investors, concepts such as responsible investment, sustainable investment, socially responsible investment, green bonds and climate bonds, can vary by provider. The extent of the options, the vast range of measurement metrics and the mixed messages can paralyse investor decision making.

Rather than getting lost in definitions, we need to start simplifying the criteria for understanding the practices of companies and their impact on society, to reward long termism over short termism.

The reality is that every company has an impact, a collection of positive and negative impacts across a range of stakeholders. Given the challenges facing our ecosystem the entire business world needs to work towards moving the needle back toward a more sustainable future and this requires companies to focus on delivering a net positive impact to society.

The Environmental, Social and Governance (ESG) criteria and the 2030 Sustainable Development Goals are useful resources to draw on, but it can be as simple as applying common sense and ethics.For example, accounting for negative externalities (negative side effects on society that companies are not required to pay for),must happen if we want a more sustainable economic model.

A paradigm shift cannot happen overnight, but if we can reduce the complexity and start with a basic impact framework that measures the impact across all stakeholders more companies can apply it and more investors can make it a core part of their investment process.

This is not about sacrificing returns, it is about delivering more sustainable returns and in turn securing the future of our ecosystem.